how timeless is timeless advice?

some advice is timeful: relevant for a specific era, but anachronistic thereafter

A common defense for conventional wisdom is that it has withstood the test of time. And lots of advice is timeless, or what you could describe as Lindy. Eat your vegetables, for example. But some advice is timeful: relevant for a specific era, but anachronistic thereafter.

Accidentally adhering to timeful advice is outsourcing a certain part of your life strategy to recent history. But when you outsource decisions that change your life trajectory, do you want to bet the house on the wisdom of yesteryear?

Silicon Valley was once uniquely good at identifying timeful advice. This power weakened as the tech industry scaled, but it is more important than ever to distinguish between timelessness and timefulness.

When I look at my own life, I’ve found that much of the advice I’ve received is dangerously timeful. Below are a few examples – my way of reconciling the cognitive dissonance between the advice I have received and my personal observations.

Should we read the news every day?

Timeful advice: Read the news every day. This is the best way to stay informed about the world.

Counterargument: Trusting news institutions is outsourcing your worldview. What important thing have you changed your mind about recently? If you can’t come up with an answer, that’s a bad sign. The media tends to reinforce your current opinions: you could think of media institutions as the original filter bubble.

The shift to ads-based revenue has weakened the business model of most internet media companies, encouraging clickbait to stay relevant. And clickbait exploits various cognitive weaknesses like fear, greed and envy.

The business model weakens more than just the titles: given the 51% layoffs in newsrooms over the past decade, news publishers have slimmer budgets for important journalistic functions like investigative journalism, fact-checking, and editorial teams.

If you take media content at face value, it deeply distorts your map of the world. For example, it may distort your understanding of common causes of death: a newsreader worries far more about homicide and terrorism (<1% of deaths) than cancer or heart disease (>50% of deaths). This leads to a sense of learned helplessness around problems; risk feels unbounded and out of your control.

Alternative ideas: I’ve limited my daily news intake, rebalancing it into concentrated information streams that are directly relevant to me. It’s become a cliche to say that the media has become a monoculture, but I’m amenable to a more binary approach of cutting out the news entirely.

Rather than outsource your trust in writers to institutions, establish direct relationships with information sources. Substack and Twitter enable this process. Vetting each information source carefully is unfortunately much harder than simply reading the news. It may take months or years to build up a good information source list. Many of the people I respect the most have an information source list curated over decades – writers, experts, friends.

One telling exercise is to read the global news headlines from a month ago – how many stories are still worth reading? The news is the popcorn of media consumption, with very low information density: 99% of it doesn’t apply to you or will be irrelevant in a week, so it ends up being a daily attention tax.

I prefer reading long-form writing, such as books and blogs. Seek high effort per word written – during the golden age of TV, the cost per episode skyrocketed, producing far superior content.

This is a uniquely bad time to be outsourcing your information sources to ML-driven algorithms and intermediaries – between filter bubbles and shadowbanning, it is best to form your own carefully curated information intake algorithm. How else might you improve your information flow systematically?

Should we buy houses?

Timeful advice: Buy real estate. It's a steady compounder investment and a safe place to put your money. In the late 20th century, there were immense tailwinds favoring homeownership:

Demographic: Buying a home was a common goal among boomers, and was completely embedded into the American culture. It was the centerpiece of the "American Dream.” Everyone wanted to own property, and "everyone" was getting bigger.

Legal: In a classic case of generational regulatory capture, the boomers changed the incentives around homeownership in their favor. The mortgage interest deduction sweetened tax bills for homeowners. And after we hit the western frontier, zoning laws ossified, fixing the housing supply while demand continued to rise.

Low interest rates: Interest rates dropped from the low teens in the late 70s to ~2.5% today, halving the effective cost of buying a house.

Counterargument: Buying real estate was a great strategy when you could buy up the frontier at low costs: think John Arrillaga in Silicon Valley, or Stephen Ross in New York. But it was timeful advice. People don't get rich from real estate like they used to, and while there is admittedly an emotional component in favor of buying, the pro-buy tailwinds are weakening.

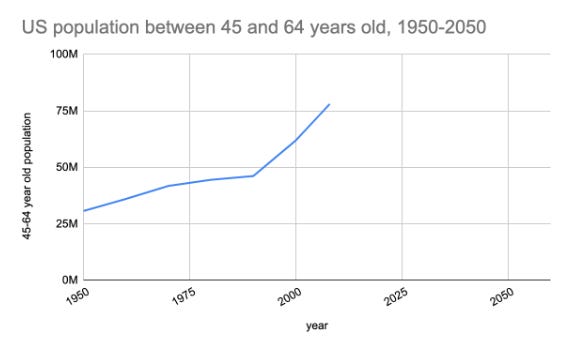

Demographic: The demographic tailwinds are much weaker than before. The tripling of the likely buyer pool in the late 20th century was a one-time growth spurt that ended around 2010, as the last Boomers entered the prime age for homeownership. Today, the number of prospective buyers is flatlining.

Regulatory: Homeownership tax incentives became fashionable when the legislators were primarily Boomers. The mortgage interest deduction and capital gains exclusion made homeownership particularly compelling. But as congress shifts from Boomer + Silent to Gen X + Millennial, these tax incentives are weakening. The mortgage interest deduction was reduced in 2017, and the capital gains exclusion may fall out of favor.

The renting generation delayed home buying given increased home prices and student debt. As homeowners age out of legislative bodies, renters will not treat homeownership favorably.

Alternative ideas: Consider the IRR opportunity cost of the down payments: how could you invest that money towards your future? You could invest into equities in the literal sense, but you could also be betting on yourself or your family with that money – investing in education (e.g. a tutor or coach), better sleep and fitness, or starting your own business.

People typically rationalize purchasing real estate by arguing that the home value will appreciate by 2-5% per year. Unfortunately, most of these gains are eaten away by inflation, and sometimes in a big way when the money supply skyrockets.

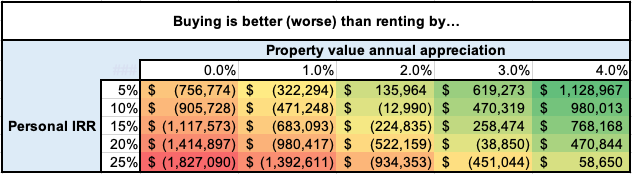

The downside of buying real estate isn't losing money, but opportunity: what else could you be doing with the down payment? If you look at a typical “rent vs buy” model, the pro-buy argument depends heavily on 1) a 2%+ property value inflation (more than true during the “settlement era”), and 2) a modest ~5% personal investment IRR (your annual yield on investments).

But what if this is flipped – low property value inflation and high personal IRR? Consider a $1m condo with market-standard HOA fees, property taxes, and interest rates:

The opportunity cost of the down payment can often outweigh the property value appreciation. You can think of the rent vs. buy decision as a function of your personal IRR and belief in the housing market.

Which quadrant are you in?

Should we prepare for a rainy day?

Timeful advice: Always prepare for a rainy day. Put 20-30% of your income into savings or retirement accounts. Invest in a safe balance of index funds and bonds.

Counterargument: This is good advice for most people – if losing your job would put you or your family at risk, high savings is a must. However, in the tech sector specifically, there is high employability, so you don’t want to over-optimize for downside protection. Insulate from existential risk, but beyond that, there are highly diminishing returns to savings.

Insurance on smartphones and consumer items, for example, has always baffled me. Many people rationalize the purchase with the logic “you never know what might happen.” Why would Apple sell you AppleCare? Because it’s profitable – AppleCare is a ~70% margin business, meaning you could save ⅔ of that money on average by skipping it. Don’t spend money to protect against limited downside – why give an insurer margin if you can afford the downside yourself?

Alternative ideas: Invest everything you can into compounding assets. But keep your expenses low, so you can focus on upside maximization without worrying about high fixed costs.

Each dollar of net income should be an investment in yourself with asymmetric upside. And investments don’t always look like investments: books and educational content are low cost but have asymmetric upside. Similarly, investing in your sleep setup or home office has compounding returns. At a larger financial scale, you could invest in your own business or those started by friends you trust.

Public equities and crypto can also be lucrative, particularly if concentrated into assets you are uniquely bullish on. In the investing context, I’ve found that conviction is the limiting reagent: it is becoming increasingly popular to trust algorithms and indices, as opposed to investing with conviction. It is convenient to trust the indexes, but resist the force of passivity. Index funds have had a good run, but 1) have bubble-like properties, 2) dampen asymmetric upside by definition, and 3) have no learning value like direct investments do.

Should we get a stable job?

Timeful advice: Start off in a stable professional track after college (consulting, banking), or get an MBA – this career move ostensibly helps establish credibility and unlock higher level jobs in any field.

Despite people vaguely knowing this is timeful advice, I still regularly see seniors at top universities follow it, as the easiest post-college default.

Counterargument: Starting in a professional role narrows the band of outcomes, so you’re less likely to fail, but no more likely to to have outlier success. A lot of careers – consultant, lawyer, banker – are still good, but they were timeful for the mid-20th century, and there are much higher leverage opportunities today if you look for them.

Alternative ideas: Many people seem to understand intellectually that following a safe career path is likely bad advice, but it is hard to identify the tactical things one could be doing differently.

What’s the exact opposite strategy to a safe career? Follow the volatility. History seems to agree: the best move historically has been to work in the most volatile industries, which tends to imply there is a frontier being forged.

Tech startups, for example, were considered highly volatile for the last 20 years – but the vast majority of people who have worked in startups for a 10-year period since 1995 have done well. But following the volatility holds true even further back in history: Wall Street in the 70s, railroads or steel in the late 1800s, international trade in the 1600s. Today, industries like biotech, robotics, machine learning, and crypto are all highly volatile.

Even within your job, you can seek volatility. Within investing, this could be learning about a frontier category that others don’t yet appreciate. Or within a startup, it could be working on the new project within the company. Or it could be taking new bets within your company, like starting a new team or initiative. It’s important to escape the 9-5 employee archetype, instead entering the payoff space, where volatility generates luck.

Admittedly, seeking career volatility is much easier when you’re young and have limited obligations to family. But importantly, many types of volatility have no career risk. Talking to strangers, writing publicly, or building side projects – things without an immediate reward alchemize luck.

Should we travel the world?

Timeful advice: Travel the world to get exposure to as many cultures as possible. This helps you to get out of your comfort zone and develop empathy for other cultures.

Counterargument: I worry that questioning the value of travel will be particularly offensive to people in my generation – nobody questions that travel is the highest form of pleasure.

But most international travel is legitimized hedonism – not harmful, but a highly privileged hobby that doesn’t serve its alleged purpose. Most tourism is highly curated, such that it doesn’t enable learning about new cultures at all.

Alternative ideas: The fact that travel destinations pitch themselves as an “escape” or “getaway” should be telling. What are we escaping from?

In the context of intellectual and psychological development, traveling to most places is no different from staying home – because you are yourself the same. Sure, the “escape” may be a drug for your current problems, but drugs don’t solve problems.

If you’re looking to explore new ideas, you can find differentiated viewpoints and cultures right around the corner, if you look in the right places. Engage with your community at a civic and social level – even San Francisco has lots of intellectual and socioeconomic diversity if you search for it. Once you escape the filter bubble, the Internet is also a good place for finding differentiated viewpoints.

Most dangerously, the Instagram era has magnified the social signaling of travel. Tulum and Mykonos more than doubled their tourist traffic since 2010. Think about whether your choice of destination is fundamentally vanity-driven. Then exclude vanity and consider the motivations behind your trip, maybe learning new things or relaxing: would you choose a different destination, different activities, or perhaps find an even more fulfilling activity locally?

Should we be in no rush to find love?

Timeful advice: You have plenty of time to find love. Enjoy your 20s and don’t worry about finding love too soon. Love happens when you aren’t looking, and you can’t force it.

Counterargument: We’re in a particularly non-Lindy time for dating: the mate-finding algorithm has shifted dramatically in just a few decades, altering the trajectory of our global progeny. A few tailwinds propel this shift: online dating driving the perception of infinite choice in mates, delay of marriage as a cultural norm, and Instagram as a jealousy farm.

Some of my computer scientist friends represent the limit case of this brave new world. They use dating app APIs to “optimize” the top of the online dating funnel, tracking their conversion rates quantitatively from match to chat to date to ____. Does something seem amiss to you?

Too many comparables makes people unhappy in new relationships – people become even less happy as they evaluate more choices, an instantiation of the paradox of choice. We are children who have eaten too much candy, but won’t realize it for ten years.

Alternative ideas: Dating is a counterintuitive area where we may not want to deviate from the timeless advice that has worked for centuries. Finding a life partner should be a serious priority in your early 20s. At some level, it is a simple but somewhat inefficient drafting problem. If you wait to commit, the pool narrows.

There’s an odd contradiction here: people optimize dating more than ever through swipes and Facetune, but commit less than ever. The blissful ignorance of pre-internet dating may be sorely missed in a few decades. Choosing someone and committing to grow with them is much more battle-tested than ten years of partner shopping.

Should we avoid talking to strangers?

Timeful advice: Don't talk to strangers.

Counterargument: Still certainly true for young children. But hearing this advice repeatedly trains you to become too insular and avoid talking to people outside of your immediate circle. And after college, it becomes a lot easier to avoid talking to strangers.

Alternative ideas: You're not talking to enough strangers. The internet massively unlocked our ability to reach anyone in the world at any time. Use this to your advantage.

A personal example: my girlfriend wrote her story about coming from a small Turkish village into Silicon Valley. The key inflection point was when she cold emailed dozens of successful businesspeople to ask them to pay for her plane tickets to Stanford. One responded and changed her life trajectory. Anyone can send an email.

Now is a better time than ever to be establishing yourself publicly early. Things that are hard to measure tend to be undervalued – talking to people online increases your luck surface area.

The world has never been more malleable, as the internet provides high leverage on new ideas. But it requires active effort to create these opportunities for yourself. Maybe there’s a company you want to learn about, an expert in a field you’re interested in, or people with similar interest areas you could befriend. What strangers could you be talking to right now?

Conclusion

There are many types of advice you should follow more, so come to your own conclusions on which advice is timeless versus timeful. Approach non-Lindy advice with caution, as it hasn’t withstood the test of time.

Know when to outsource vs. insource your strategy. Things you want to look for when evaluating strategic decisions:

Compounding: If the outcome of your decision will compound, insource. Your personal financial strategy, for example: the dollars in a given financial decision may seem small, but the compounding effect of finance makes the outcomes highly consequential, such that the seemingly small benefit of insourcing is larger than it appears.

Irreversibility: Can the decision, once made, be reversed? If not, insource. Career paths and partners are hard to reverse.

Stereotype: If you’re making a decision because it’ll help you fit in, you should think twice about it. People often travel to fit in, and they subconsciously understand this: if you didn’t post on social media about your trip to Cabo, did you really go? Not all cultural consensus is bad, but stereotypes are a form of ill-supported consensus, so they’re worth questioning.

Iteration: If you do something repeatedly, like reading the news, you should think more deeply about how and why you’re doing it. Sleep, diet, and entertainment also fall into this category.

Magnitude: This one is most intuitively obvious. If the decision you’re making is obviously big, like your choice of career, it’s worth insourcing.

As a rule of thumb, when there may be asymmetry in the outcome, it is probably best to insource the decision.

When an important strategic decision arises, ask yourself if you’ve inherited defaults from people around you. Owning your future requires active questioning of “timeless” advice and coming to your own conclusions.

There is probably lots of advice that I haven’t even thought to question yet. What am I missing?

Thank you to Brandon Camhi, Julian Shapiro, Melisa Tokmak, Sam Altman, Russell Kaplan, Axel Ericsson, Michael Solana, Anna Mitchell, Sam Wolfe, Gaby Goldberg, Jason Lopata, Bala Chandrasekaran, Anna-Sofia Lesiv, Quinn Barry, and Tomcat Sanderson for their thoughts and feedback on this article.

Really liked the framing for this! The one piece of timeful advice that didn’t land as well was being in no rush to find a partner in your 20s. Anecdotally, friends who prioritized learning about themselves over finding a partner in their early 20s seem to have fared well because of that decision - they understood much better their values, how they wanted to live their life / spend their time, and who would be a good counterpart given those things.

Always enjoy your writing ! :)

Great read!

I disagree on the idea that passive investing isn't the right way for ~everybody. The bubble argument is wrong/overblown, most people learn as much from trading individual stocks as they do from a trip to the casino and diversification is the only way to almost surely reap the benefits of compounding.