this week i'm thinking about – #15 – online dating

Hey friends,

Welcome to the many new subscribers since last edition! Feedback and suggestions are very welcome, especially from the new folks. I've been working a lot recently so please pardon my absence.

I’m writing an occasional blurb about something I learned that’s broadly tech-related. If you have thoughts, I'd love to hear from you, and I'll paraphrase the best responses in the next newsletter. My goal is to start conversations with people thinking about similar topics through different lenses. If you know anyone who would be interested in the discussion, please do forward this along, send them to the archive, or have them subscribe here.

John

What I learned about: IAC & Match Group 💒💑

Ever since reading the OKCupid data science blog in 2009 (I was in 8th grade), I’ve been fascinated by the implications of online dating. It produced an unprecedented dataset around social preferences. But 10 years later, online dating has produced much more than an interesting dataset: nearly half of all couples in 2019 meet online:

In the online dating acceleration of the last two decades, Match Group – the owners of Match.com, Tinder, Plenty of Fish, and OKCupid – has captured the vast majority of that value and is now a $21B standalone company. They also own a variety of niche dating websites: OurTime (50+ y/o dating), Meetic (French dating), Pairs (Asian dating). Match Group’s success (~5x since selling 20% of IAC’s equity via IPO in 2015) is no surprise given the chart above and their ownership of 4 the top 5 dating sites by MAUs. I don’t see the red line reversing any time soon.

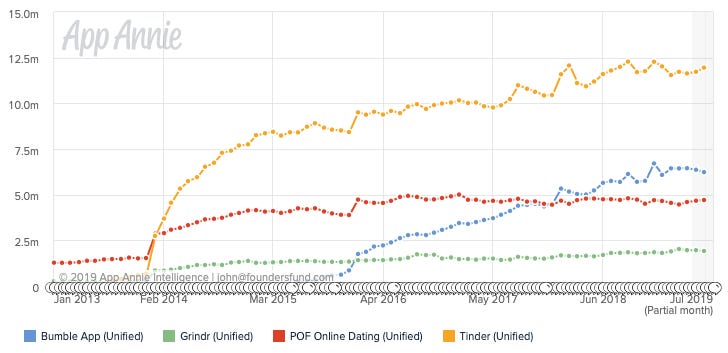

On mobile specifically, all dating apps were below 1M MAUs in the US until early 2013:

And today, the top 5 apps have more than 100m worldwide combined MAUs. This is a well-understood cultural shift, but I don’t think the implications have been widely discussed within SV. This is largely because the largest dating apps are outside of Silicon Valley’s purview: Tinder was acquired more than five years ago, Grindr was made in China, IAC has stayed largely under the radar, Bumble is owned by a Russian conglomerate.

We’re moving away from a world where dating “algorithms” are decentralized: there was historically no central authority deciding who should go on a date with who (except maybe the church). Instead, dating matches 100 years ago were informal and distributed: who happened to be in the same bar, who your friends were friends with, who your parents thought you would like. The matching process is now incredibly centralized, and controlled by relatively discreet companies. A handful of companies have a surprising amount of power in determining the future socioeconomic and demographic makeup of our country. Small UX and algorithmic tweaks can lead to massive changes in interracial and inter-socioeconomic marriages – and the opposite is also true. For example, encouraging users to widen socioeconomic filters for matches (or constraining the filter by default) can meaningfully impact preferences for users who are still determining their ideal candidate. Similarly, the apps can easily filter out certain demographic groups given your historical swipes, which could cut off your likelihood of matching with wide portions of the population.

These companies’ cultural and demographic importance seems to dwarf their market cap. From a regulatory perspective, this is unchartered territory. Is this something the government should have any say over? I’m not sure what’s worse: our dating algorithms being controlled by China and Russia, or the US government. What do you guys think?

See these links if you want to read more about:

Race and reply rate matrix, race and attraction matrix (two interesting old OKCupid posts)

OKCupid blog archive (this is a gold mine for pseudoscientific dating data)

Hinge IRL blog post on how school affects dating app reception

What I’m reading 📚

How Rupert Murdoch’s Empire of Influence Remade the World – one of my favorite NYT feature pieces of all time (warning: long read)

Chinese computer vision company Megvii raises $750M ahead of IPO (still think the US is way behind on this)

The Emerging Market Fallacy: has investing in EM actually been a good bet to take? How tightly correlated are GDP growth and equity growth in emerging markets?

Drug prices 101, helpful to understand high-level payment flows within pharma

Justice Department opening antitrust review of big tech – I still expect Apple is the biggest culprit here (may do a newsletter on this, if you’re interested let me know!)

Is the gig economy a myth? Good WaPo article on how much the gig economy has actually shifted American jobs so far.