The index mindset

Index funds have come to dominate public markets. But the shift towards indexing is spreading across tech, careers, and culture too – in what I call the index mindset.

Through the 1980s, gut-driven active fund managers on Wall Street dominated money management and ridiculed index funds as “a sure path to mediocrity”. Sure, index funds’ fees were 80-90% lower than those of active managers, but aiming for average is un-American.

Yet as active managers underperformed the index 80% of the time in the coming decades, the argument favoring passive funds became a no-brainer: why pay higher fees for worse performance?

Even Warren Buffett, famous for his concentrated portfolio, now tells us to simply invest in index funds. Correspondingly, public index funds have doubled their market share in the last decade – a multi-trillion dollar transition from active to passive assets.

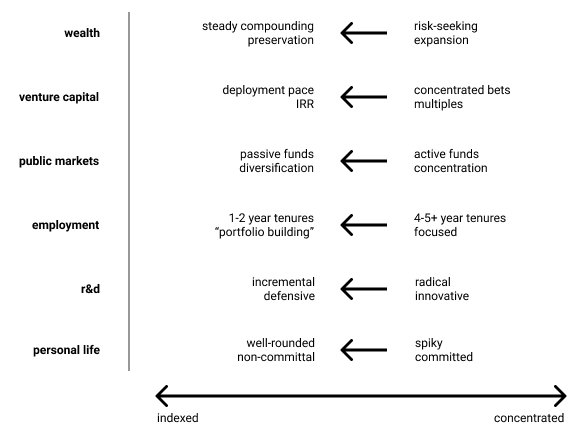

This pro-index tendency pervades the private tech markets, startups, and even our culture through what I call the index mindset: a focus on preservation over creation, optionality over decisiveness, general over specific. Public companies are an obvious thing to index, but the index mindset manifests in many domains:

Internet and software companies are far less risky than they used to be, even at the early stages: there hasn’t been a venture vintage since 2002 with negative median returns. Big tech is now huge tech. Risk-averse people and money have flooded in. When people have something to lose, they protect their downside – think of wealth managers, encouraging a “safe” mix of stocks and bonds. The tech industry has too much to lose.

Indexing may be the correct default for public investors, but can be dangerous when replicated in other domains. The public markets show us the second-order effects of indexing, so we can learn how it affects the private markets, startups, and culture.

Indexing in the public markets

Given the index mindset has snowballed the longest in the public markets, we can see that when the plurality of investors are passive, the implications are not passive at all.

Record-low interest rates since the 1980s enticed retirement money to flow into the US stock market. With low fees and returns that were hard to beat, index funds became the dominant sub-strategy, now constituting 14% of the US stock market.

Everyone knows that “past performance is not indicative of future results”, but nobody believes it. In the case of index funds, it has been indicative. Index funds are a reflexive asset: because US funds have attained consistent returns, retirement money pours in, driving asset inflation and more buyers.

In the public markets, investors can no longer solely rely on the DCF model of investing. As index fund capital flows approach 50% of the stock market, the indices themselves distort asset prices. It is important to ask ourselves, why should a low-conviction index bet generate any return at all? There must be some external force: that’s retirement savings pouring into the assets behind you. As index funds became a generational asset class, their returns were driven as much by demographic trends as by the underlying companies’ fundamentals.

The common intuition is that when everyone zigs, you zag... but index funds make another zig the optimal strategy. There is an uncomfortable pyramid scheme dynamic to capital flows: your investment performance is aided by the volume of capital behind you. The retirement savings capital inflows could revert, but are alive and well for now.

The importance of capital flows back-propagates into privates, too. Blackrock, Vanguard, and State Street are the largest buyers of public companies. Given every private investor underwrites valuations based on what the next round’s investors will pay, all private investors are beholden to the IPO buyers as the Series N+1 investors.

When capital inflows increase for private markets, it reinforces the indexing approach, in the same way that public index funds become reflexively good.

Indexing in venture capital

The index mindset is more obvious in venture capital than in any other asset class. Tiger Global, the private tech index fund, dominates VC partner meeting discussions. Those VC firms themselves are scaling and diversifying. And the increasingly popular venture capital job itself is the ultimate indexed career, a bet on a basket of companies.

Growth investors often use a framework of how quickly an investment will be “in the money”; in other words, how quickly another growth investor will pay more for it. This is implicitly a bet on capital flows more than intrinsic company value. And when everyone thinks this way, momentum becomes self-fulfilling. Capital flows govern the public markets, where index funds prevail. This is increasingly true in venture capital.

Venture fund indices prioritize momentum over value, such that fundamental business characteristics matter less: efficiency metrics and company-level profitability give way to growth. “Checkbox” investment strategies from the last decade won, which was in essence frontrunning future index fund algorithms.

Public macro investor Michael Green speculates that index funds weaken mean reversion characteristics: overvalued things should be purchased less, but market cap-weighted index funds purchase them more. We’re already seeing this in growth stage investing: companies that check enough boxes are purchased with increasing price agnosticism.

To make outsized returns in venture capital, you need to believe in companies when others don’t. But for the last decade, many investors who claimed to be VCs were actually index investors chasing a checklist of 3x+ growth, 100%+ NDR, 70%+ margins, and recurring revenue. These investors are commoditizing overnight, just like stock brokers on Wall Street in the 1980s.

Most seed-stage investors have a high-volume investment approach: the conventional wisdom is that “you can’t know which company will return your fund, so take a lot of shots.” This could accelerate significantly into a true seed index that aims for high market share and deployment pace: a scaled seed index fund still doesn’t exist. But things start to break down at this stage: seed investors often act as advisors to fledgling companies, which doesn’t scale.

VC is commoditizing more broadly – finance types have flooded in, growth funds are raised and deployed far more quickly, investment teams have scaled, and deal-level competition has intensified. It is no longer the boutique asset class that small funds were betting on. You need scale to make an indexing strategy work – this could drive a consolidation era of venture capital, with far fewer funds.

Indexing in startups

The index mindset has pervaded startups, too. Employee tenure is short and shortening, with many employees opting to collect a portfolio of equity across several companies, hedging their downside along the way.

The proxy war of the index mindset in startups is quadratic vesting: employers are trying to combat micro-tenures with back-weighted vesting for employee equity. This is partially a function of scale: tech is now a place where normal people come to build careers, not just nerds tinkering around.

In day-to-day strategic trade offs, the index mindset also reigns. In marketing, conventional wisdom says to eventually build a portfolio of distribution channels to prevent concentration risk, instead of focusing on your best channel. In sales, it’s generally preferable to have lots of small customers versus a few whales. In positioning, startups try to check as many boxes for as many customers as possible, instead of resonating deeply with a narrow audience.

Even founders, who are on the highly concentrated end of the indexing spectrum, have started to diversify. Secondary sales happen earlier and are more common than ever before. Many founders have side hustles as angel investors, or even as part-time fund managers.

The limits of the index model are clear when it comes to company formation. In a world where people speak in probabilities, it is easy to forget that great startup ideas and teams stem from intelligent design, not evolution.

Founders can’t afford to index their market: a seed round only allows for a handful of product bets, particularly in a mature ecosystem with immense company-level competition. As Keith Rabois put it, “product market fit is forged, not discovered”.

Indexing in culture

We can also see the rise of the index mindset in culture, in the form of diversification and risk avoidance.

In philosophy, we’ve seen a shift from a singular truth in moral absolutism to a multitude of truths within moral relativism. In physics, a shift from a deterministic Newtonian physics to probabilistic quantum mechanics.

In politics, globalism swiftly replaced nationalism in the political zeitgeist post-World War II. This is the easiest to see vis a vis the establishment of the European Union and the Euro, a way for the member states to bet on an index of other countries instead of themselves.

Private life has also become indexed. Just a few decades ago, marriage at a young age was common, with one partner assigned for life. Today, Tinder allows people to diversify their relationship capital across an index of dozens of partners.

Even career choices have become indexed and hedged. Nearly 40% of Harvard grads work in banking or consulting after graduation – choosing a basket of potential career opportunities without committing themselves to one. And the projects within consulting and finance jobs are indexed across many industries and disciplines.

Parents encourage the index mindset, too, disguised as well-roundedness: a collection of hobbies and extracurricular activities that make their children broadly appealing to academia and industry.

When America was founded, it was a frontier. Each citizen had minimal possessions. Over the centuries, Americans have accumulated financial and relationship capital, giving themselves something to lose. This wealth went parabolic in the 1960s, and since then, we’ve become afraid of taking risks: marriage comes six years later, schooling lasts 5 years longer.

The index mindset is comfortable – avoiding decisions requires the least amount of effort. But if you index across every domain, you lose your differentiating features, becoming an average of everyone else.

Indexing in the 2020s

The index mindset emerges in any highly liquid market, and technology supercharged liquidity in many markets: financial markets, job markets, dating markets. Regardless of our participation, the index mindset is here to stay.

The biggest consequence in tech is already here: ecosystem-level inflation as money floods into tech indices. Investors must pay higher valuations. Startups must pay employees more. Sales and marketing teams must pay more to acquire customers. Private tech inflation will only accelerate. If opex inflation outpaces pricing (revenue) inflation, then tech could become far less profitable.

Other consequences like fragile valuations are harder to see. Employees should be wary of assessing startup equity in the context of index fund valuations. VCs should be careful about how price changes represent fundamental business changes; maybe their markups should be reported on a volume-weighted basis. Venture backing doesn’t qualify companies like it did in the early 2010s.

As the world shifts towards passivity, you have a personal choice: join the index, or avoid it entirely.

Adopting the index mindset is the easiest default. You don’t have to think too hard. And it often works, if you get the highest-order bit correct: indexing the tech sector in 2010 was a great decision. It can also be useful as a jumping off point; purchasing a basket of crypto or biotech stocks, for example, may encourage you to learn more about the technological frontier.

In the investing context, you can frontrun the index: compete on speed, think about where the index is going, and try to get there first. Maybe you invest in companies that are ESG friendly, suspecting they’ll earn a premium in the index moving forward. Or you invest in a lot of early-stage startups before they enter the index.

Trusting the index fully can be dangerous. Index funds are reminiscent of the CDOs of 2008: don’t worry about the underlying assets, we were told, and trust ETF algorithms and tax-loss harvesting to optimize returns. When nobody pays attention to the details, things can go wrong. The index may hold a lot of junk under the surface.

Many of the most successful individuals have thoroughly rejected the index mindset. Elon Musk, for example, isn’t spreading his bets – in fact, he’s buying more of his companies’ shares. And Warren Buffett, despite preaching index funds, has 75% portfolio concentration in five stocks.

Indexing provides a safety net against failure, so it can be hard to reject. But you can start small. Every index has underlying assets that are below average, so you can start by identifying which components are weighing it down. This could be empty relationships, weak investments, or unfulfilling hobbies. Over time, narrow the index into a handful of bets, each of which you can staunchly defend.

Abandoning the index mindset may be more valuable than ever. When everyone is indexing, their collective trance distorts reality. That’s your opportunity. There isn’t a singular answer about when to adopt versus abandon the index. But the index mindset is sedative, a substitute for conviction. And conviction pays off, as Howard Marks succinctly put it: “if you wait at a bus stop long enough, you're sure to catch your bus, while if you keep wandering all over the bus route, you may miss them all.”

Thank you to Luke Constable, Brandon Camhi, Harry Elliott, Everett Randle, Sam Wolfe, Melisa Tokmak, Josephine Chen, and Axel Ericsson for their thoughts and feedback on this article.

A small thought to consider: instead of the "index mindset" or "cheems mindset", what is the barbell strategy (conservative-risky split) against this? https://normielisation.substack.com/p/personal-cheems-mindset https://normielisation.substack.com/p/personal-cheems-mindset/comments?s=r

Also as a side note, "Midwit" can also fall in this general category of behavior of mindless bet-hedging https://alima.substack.com/p/midwits-and-the-office?s=r https://www.dwarkeshpatel.com/p/barbell-strategies https://web.archive.org/web/20210302000146/https://www.mightyknowledge.com/use-the-barbell-strategy-for-risk-taking-in-your-life/

A final thought from the academic literature that supports your shift in mindset from an entrepreneurial opportunity seeking to a protective mindset. It fits well with Harvard Professor Howard Stevenson's contrast between entrepreneurial behavior with administrative behavior. (Stevenson, 1983; Stevenson & Jarillo, 1990). Stevenson considers entrepreneurship "as the pursuit of opportunities without regard to resources currently controlled" (knowing money flows to good ideas). At the other end of the spectrum is an administrative mindset reflected by protective behaviors and strategies making use of resources currently under control.

Colleagues of mine published a nice operationalization of Stevenson's theoretical paper with the measures covering several dimensions related to: resources, strategy, culture and management (Brown, Davidsson & Wiklund, 2001). The measures are in the paper Appendix. Could be an interest part of a portfolio investment screening process?

I used the measures in one of dissertation papers. My model had the Ent. Management dimensions as mediating effects between slack resources and growth. Several ent management dimensions were sig and positive with growth and financial slack had a direct positive relationship with growth. However, slack resources were negatively associated with the Ent Management Dimensions. I concluded these factors for growth were tradeoffs rather than enhancers together. Resource constraints, within reason, encourage resourcefulness exhibited as entrepreneurial management behaviors (Bradley, Wiklund, Shepherd, 2001).

Bradley, S. W., Wiklund, J., & Shepherd, D. A. (2011). Swinging a double-edged sword: The effect of slack on entrepreneurial management and growth. Journal of Business Venturing, 26(5), 537-554.

Brown, T. E., Davidsson, P., & Wiklund, J. (2001). An operationalization of Stevenson's conceptualization of entrepreneurship as opportunity‐based firm behavior. Strategic ManagementJournal, 22(10), 953-968.

Stevenson, H. H. (1983). A perspective on entrepreneurship (Vol. 13). Cambridge, MA: Harvard Business School.

Stevenson, H. H., & Jarillo, J. C. 1990. A paradigm of entrepreneurship: Entrepreneurial management. Strategic Management Journal, 11: 17-27.