Finance as culture

Financialization is no longer purely institutional. It has seeped into our culture.

Financialization (noun): the process by which financial institutions, markets, etc., increase in size and influence.

In practice, what does financialization look like? We’ve all heard the institutional narrative. The US stock market has nearly tripled in the past 10 years. The FIRE sector (finance, insurance, real estate) now accounts for 20% of US GDP, versus 10% in 1947. S&P buybacks nearly doubled in the 2010s. IPOs grew 2.5x in 2020.

But financialization is no longer purely institutional; it has seeped into our culture. A combination of low interest rates, a historic tech bull run, and the resulting torrent of fomo has tethered us to our monitors to watch candlestick charts. The financialization of culture has manifested in two primary ways: lottery culture and equity culture.

Lottery culture

We’ve always had lottery culture, in which people trade assets hoping to make money without understanding or conviction of their fundamental value. In the summer of 1929, for example, Joe Kennedy’s shoe shine boy gave him stock tips, signaling the market peak.

But lottery culture has exploded in the past few years. Robinhood has achieved its vision of democratizing access to financial markets, boasting over ten million monthly active users and exponential growth. Retail investor trading as a percentage of stock market volume has more than doubled since 2010. When “stocks only go up”, people realize the stock market is a casino with much better payouts. Gamified trading has tethered us to our phones and bank accounts.

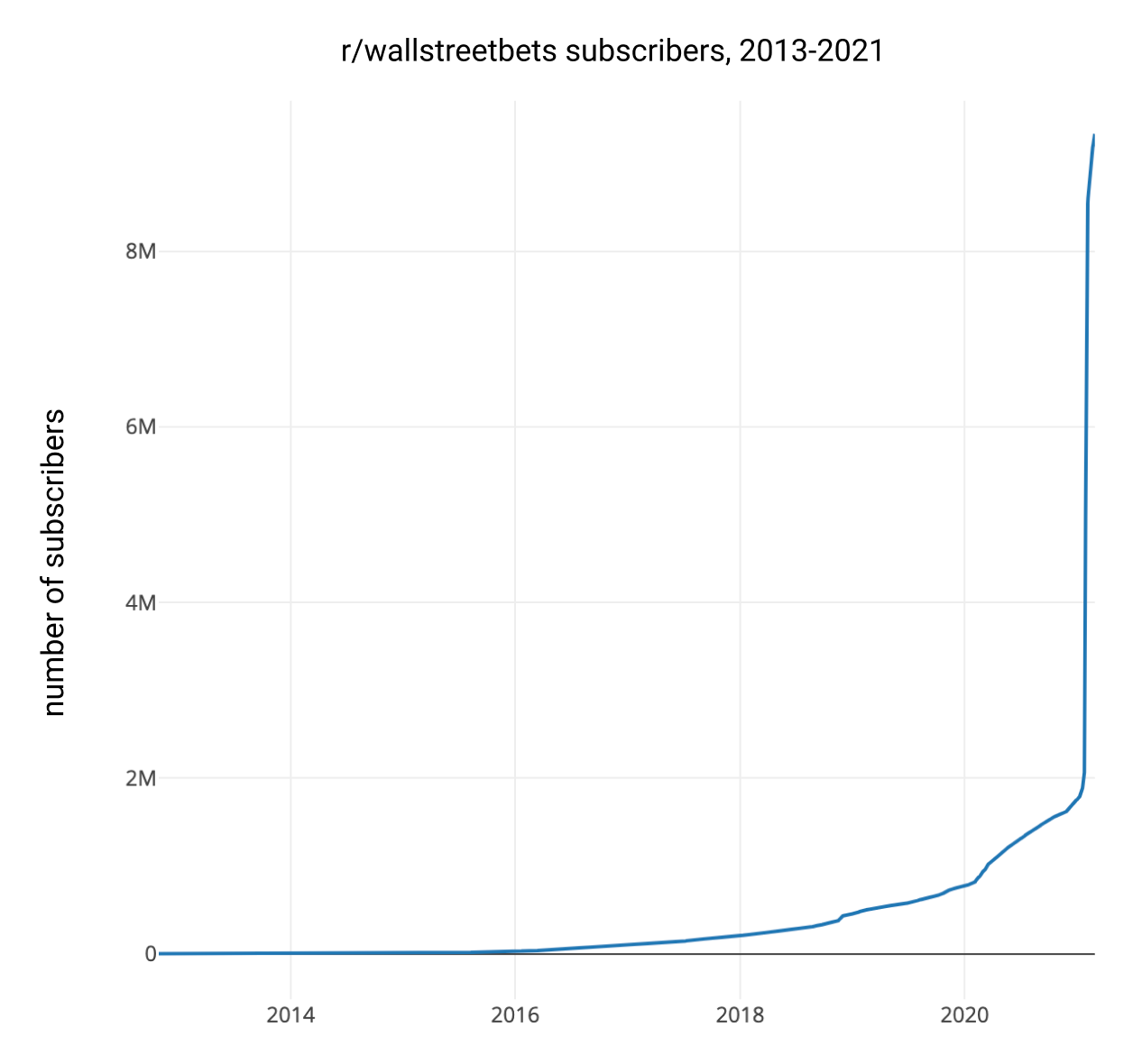

Through GameStop, even protest became financialized. At the peak of the GameStop saga, millions of Americans owned GME, arming themselves against hedge funds. This was part protest, part nihilistic hail mary to get rich. The number of subscribers to the wallstreetbets (WSB) subreddit certainly spiked in 2021, but the exponential compounding for years beforehand implies a degree of inevitability:

Memes took lottery culture to new heights. Stocks popular among a retail audience, like Apple, have historically traded at higher multiples than others in their category. Tesla accelerated the divergence between retail excitement and fundamentals: TSLA revenue grew 50% over the past two years, but meme culture helped its market cap grow by 12x. GameStop completed the meme-fundamentals duality: investors don’t even pretend that the company’s fundamentals will ever substantiate its market cap.

WSB revealed where Robinhood culture was headed all along: a nihilistic lottery. It was historically viewed as a disorganized and degenerate mob, but the mob has evolved into a laser-focused and motivated militia.

Even outside of WSB, another clear sign of lottery culture is the focus on technicals over fundamentals. Many “smart money” investors don’t rationalize investments by talking about the fundamentals of the business, or even conviction in its future. Instead, we’ve seen the emergence of chartism, which advocates for investing not based on where the business is today or where it’s headed, but its likeness to a “cup and handle” or “head and shoulders” pattern. This is the astrology of finance.

For those who want more risk than public equity markets provide, a long tail of speculative assets are exploding – digital collectibles, DeFi, Bitcoin. Bitcoin grew more than 5x YoY. Collectibles like NBA Top Shot did $60m in sales in a week. DeFi (decentralized finance), the infrastructure powering the casino of crypto, had a $40b influx in the past few months. Dogecoin is worth more than $6b.

Speculation now dominates culture.

Equity culture

Equity has been a great mechanism to align labor and capital. As tech equity has gone parabolic, there is now a prevailing sentiment that equity holders are getting rich, and you’re not. In the tech context, this means that startup jobs are viewed as an offer of equity, with four years of indentured servitude attached. To be a software engineer in 2021 is to be a financier.

It wasn’t always this way. In 1970, a young engineer named Mike Markkula was offered 1,000 options to join Intel, their standard grant size. He then asked for 20,000 options, and the company agreed. Very few employees – and companies – appreciated the value of equity at the time.

Today, it is hard not to notice the prevalence of equity culture. Every employee optimizes their stocks and options. People frequently move between companies to build a portfolio of equities. Employees of successful startups want to become angel investors. Second-year MBAs want to be founders or VCs. Nobody wants to miss out on the next equity success.

Equity culture has become labor emulating capital. People aggressively negotiate and hold equity more than ever, seen as the golden ticket out of the tyranny of 9-5.

How did we get here?

The combined effect of equity and lottery cultures is omnipresent. And there’s a reflexive loop between equity culture and lottery culture: lottery culture creates the perception of easy wealth creation, and equity culture responds with more aggressive buying and holding, lowering supply and pushing up asset prices.

2020 accelerated finance culture: stimulus checks, nothing to spend money on, and lockdown boredom drove people to the stock market. But the driving forces behind the financialization of culture have been accumulating for years. We need to look at interest rates, tech maturity, inequality, and social media to understand the full picture.

Low interest rates

Interest rates don’t tell the full story, but they tell a lot of it.

The value of a financial asset is classically calculated as the cash it is expected to generate, discounted into the future – this discount rate is closely tied to interest rates. The present value of a business is the multiplicative inverse of the discount rate: as the discount rate approaches zero, the present value of equity climbs exponentially.

Take a company generating $1m in annual cash flow, growing 30% per year with a 15% growth rate decay. We can then calculate the net present value of the next 50 years of cash flows. If we use a 2% discount rate instead of 10%, the present value is 5x higher:

Importantly, low discount rates most heavily impact the valuations for companies with cash flows far in the future. Nikola, for example, has practically no income but promises cash flows on a multi-decade timescale, earning a $7b market cap. A 1% change in interest rates makes a one-year bond change in value by ~1%, but could change Nikola’s value by 20% or more. Stated differently, if you don’t discount cash flows, you believe the future is all but certain.

But there’s a principal-agent problem: by giving Nikola the valuation it deserves in 50 years, a disconnect emerges between current equity holders (principal) and the employees that will eventually need to build the trucks (agent). If I’m an employee of Nikola and my stock is now worth what I was hoping it’d be worth in 10 years, what incentive do I have to stick around another decade to build the trucks?

In the tech context, it’s becoming more common to see founders selling shares before the company reaches escape velocity, and employees rotating between hot companies before they have a chance to own projects end-to-end. Too much capital makes it more compelling to chase easy financial gains than build new tunnels.

When interest rates decline, businesses take more risk, which is good for innovation. But as rates approach zero, everyone with a high payout expected far into the future suddenly drowns in money, perversely distracting from innovation. This leads to a counterintuitive relationship between interest rates and innovation:

Tech maturity

Financialization is a byproduct of the narrowing of the visions: there are more engineers working at Dropbox today than at Apple when they released the Apple II. The explosion of tech wealth and headcount translates into many smart ambitious people doing tech with the expectation of transitioning from labor to capital.

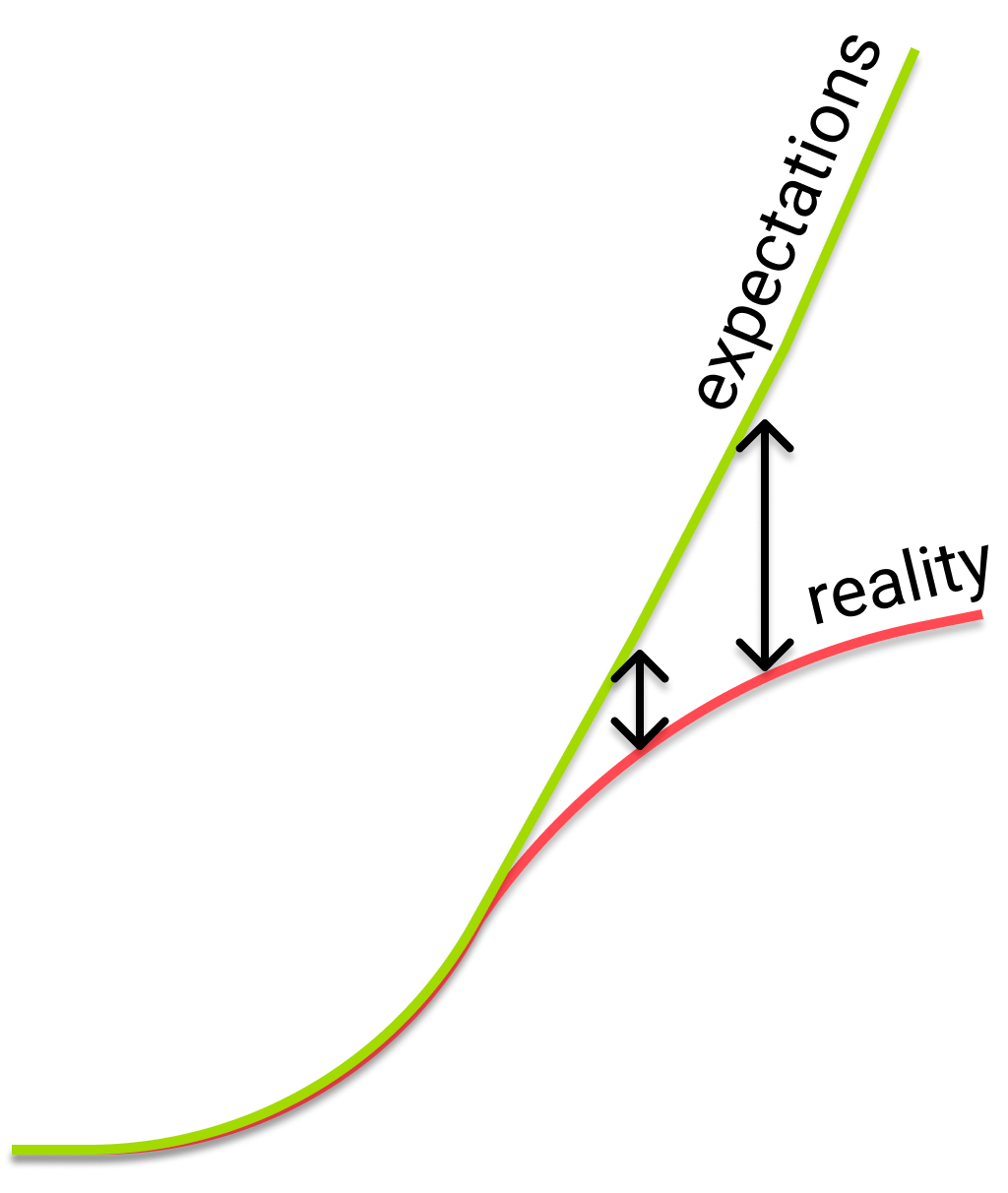

When reality is an S-curve but expectations are exponential, the gap between the two curves drives financialization as investors find new ways to crowd into the same trends. The wider the gap, the more crowded it feels.

As “naturally aspirated” internet growth slows, investors need to take more risk to generate the same returns. This is why we see a rotation from “safe” tech assets into far riskier alternative assets – Bitcoin, DeFi, early-stage startups.

I often hear comments that the tech industry is becoming financialized at the corporate and individual levels. But financialization is natural as an innovation cycle matures, and was amplified as the internet became far more lucrative than anyone expected. Simultaneously, tech is taking over pop culture – the real story behind Clubhouse is that SV is now a major cultural exporter. The product of the financialization of tech and the techification of culture is pervasive finance culture.

While it may seem like the party is over, the plateau of the internet is a good thing for technological innovation. As late stage and public internet companies become fully valued, investment dollars shift further down the risk curve into new technologies.

Inequality

Labor’s share of income is declining across countries; in the US, it fell from >63% in 2000 to <57% today. COVID accelerated this dislocation between labor and capital. The further the disconnect between labor and capital, the more resentment we see between them. GameStop was the greatest invasion of labor into capital since the Peasants’ Revolt – a financialized flavor of class warfare.

The Gini coefficient is a classical measure of inequality, and it did increase from 0.43 in 1990 to 0.48 in 2020. But the inequality is far clearer on industry lines: the NASDAQ has generated 2.5x better returns than the S&P 500 since 2008. When the growth of tech’s contribution to GDP far outpaces other industries, but its total employment stays roughly flat, it is hard not to see the rest of the country missing out.

As people drown in record student debt, the appeal of a lottery ticket win as a way out is stronger than ever. The easiest way to emulate the financial success of the tech sector is to get equity in tech companies. Robinhood has accelerated this process in the public markets. In the private markets, employees are far more clued into the equity equation, aggressively negotiating on options since they now viscerally understand this is the way tech money is made.

Social media cultural amplifier

Social media makes income inequality noticeable in a way it never was before. In the 70s, the mega-wealthy stayed to themselves in Greenwich and Monaco. The only way the masses saw wealthy lifestyles was through the Hollywood lens.

Today, social media is a magnifying glass for wealth. Posts of wealth generation abound: from DFV’s reddit posts, to Chamath’s IRR tweets, to Elon’s Dogecoin memes. Social media acts as an emotional coordination layer, increasing the amplitude and frequency of culture. Jealousy, resentment, and fomo are more viral and powerful than ever, particularly when everyone is on their computer all day post-lockdown.

What Instagram did to body image, wallstreetbets and Twitter are doing to bank account image.

Where does this lead?

It’s not entirely clear where the financialization of culture goes from here. The accelerative version of the story seems impossible: if we're all sitting at our desks watching candlestick charts, who is going to build the future?

There’s a bubble version of the story, similar to the dot com era: at some point, we could see that the emperor is wearing no clothes and the market crashes 80%. Maybe we’ll see this effect localized, in nihilistic cases like GameStop or some crypto. And if rates rise, highly exotic companies drowning in money today may not get funded: a company not expecting to make money for two decades could see its value fall more than two-thirds if rates returned to 2019 levels, even if nothing about its expected cash flows changes.

Similarly, we could see a populist reversion of the forces that have favored capital over labor: the economy may outperform assets if we see a pro-labor shift in tax policy, increased union presence, or accelerated fiscal transfers. In this scenario, maybe retail investors retreat from the investing landscape for a long time, and equity culture subsides.

The second version of the future is a squeeze, where low interest rates continue and the internet plateaus. Thus entry prices get higher, we see lower market CAGRs for key industries, there’s more competition at the company and fund levels. This may be a good thing: low yields for internet companies means we’ll shift to investing in new platforms like biotech, machine learning, space, and robotics. Speculative companies will grow into their valuations, and we’ll get a steady realignment between equity and reality.

There’s a third version where finance as culture continues. The aggregate S&P P/E ratio is high, but not wildly out of whack on a historical basis. We’ll continue to see a rotation of meme stocks, each its own bubble. Intense fomo of equity holders will continue, accelerating a sense of urgency across lottery and equity culture.

I suspect finance as culture is here to stay.

Thank you to Harry Elliott, Eric Wang, Sam Wolfe, Pranav Singhvi, Delian Asparouhov, Philip Clark, Julian Shapiro, Melisa Tokmak, Brandon Camhi, Axel Ericsson, Everett Randle, Tomcat Sanderson, Napoleon Ta, Josephine Chen, and Daniel Singer for their thoughts and feedback on this article.

Phenomenal John. One q though, is it truly nihilistic? They seem to believe pretty religiously in the power of the meme itself. Maybe you've uncovered a new religion based on mimesis, not just as the means of transmission, but as the basis of meaning. Elon is prophet, Doge the sacred cow / golden calf, heaven = moon / mars, heathens / hell = no-coining, temptation is weak hand, proof of faith is HODLing for which you will receive many kingdoms worth of riches.

Loved the way you laced the topics of social media, equity ownership, lottery culture, FOMO.. Its reality presented in the most digestible format.